Crypto is becoming increasingly popular as an investment option, and with that comes the need to calculate your taxes on your crypto gains. However, calculating your taxes on your crypto investments can be confusing, especially if you are new to the world of cryptocurrencies. In this article, we will guide you on how to calculate your crypto taxes like a pro.

Understand the Tax Laws

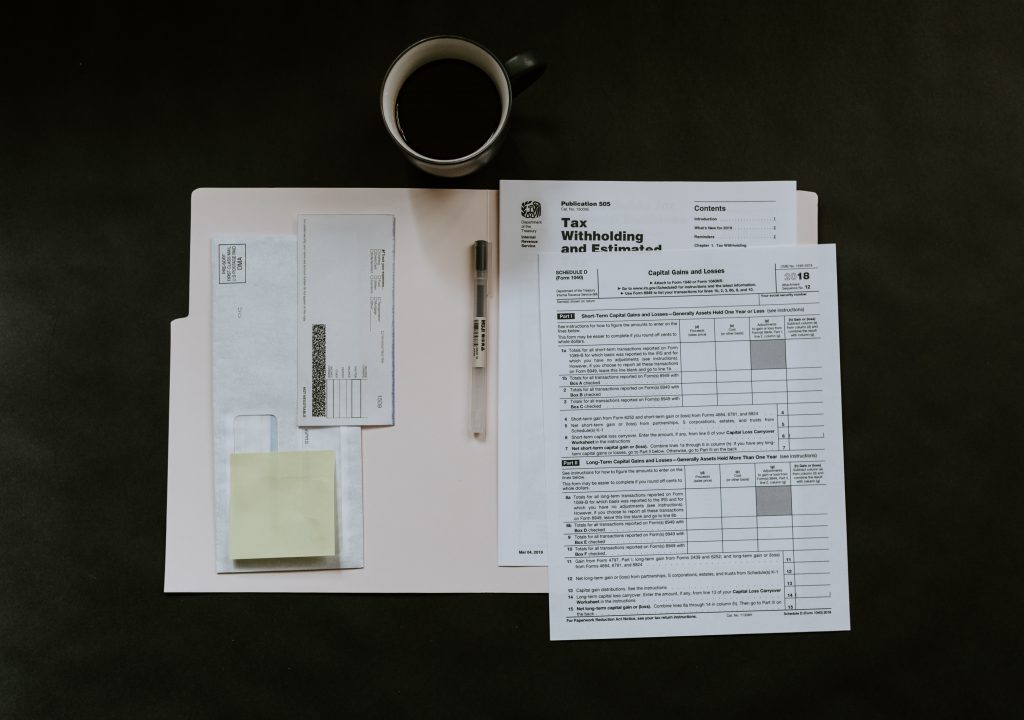

The first step in calculating your crypto taxes is to understand the tax laws. The tax laws regarding cryptocurrencies vary from country to country, so it is important to understand the tax laws in your country. In the United States, the IRS treats cryptocurrencies as property, which means that they are subject to capital gains tax.

Determine Your Cost Basis

Once you understand the tax laws, the next step is to determine your cost basis. Your cost basis is the amount you paid for your cryptocurrency. It is important to keep track of the cost basis of your crypto investments as it is used to calculate your capital gains.

Calculate Your Capital Gains

Now that you have determined your cost basis, the next step is to calculate your capital gains. Capital gains are the profits you make from selling your cryptocurrency. To calculate your capital gains, you need to subtract your cost basis from the amount you received when you sold your cryptocurrency. The resulting amount is your capital gain, which is subject to capital gains tax.

Keep Accurate Records

To ensure that you are calculating your crypto taxes correctly, it is important to keep accurate records of your transactions. This includes keeping track of the date, amount, and type of cryptocurrency involved in each transaction. You should also keep a record of the value of the cryptocurrency at the time of each transaction.

Consider Working with a Tax Professional

If you are still unsure about how to calculate your crypto taxes, consider working with a tax professional. A tax professional can help you navigate the complex world of crypto taxes and ensure that you are calculating your taxes correctly.